SKD61—internationally aligned with H13 or DIN 1.2344 tool steel—has long been the default hot-work tool steel used in die-casting, forging, extrusion, and many forms of heavy-duty mold manufacturing. The material is engineered to withstand high thermal shock, maintain strength at elevated temperatures, and offer predictable performance during heat treatment. Because of this combination of stability and strength, it continues to dominate more than half of the global hot-work tooling market. In wholesale environments,buyers often source multiple tons at a time, two concerns repeatedly appear: selecting the correct, realistically available dimensions, and ensuring that delivery timelines do not harm production schedules.

This article integrates market data, mill-level production knowledge, and common logistics practices to offer a realistic guide for wholesale SKD61 buyers seeking faster, more reliable procurement.

What Makes SKD61 Important for Industrial Buyers?

The value of SKD61 lies in its versatility. It maintains strength in the 400–600°C range, exhibits stable hardenability, and resists cracking under rapid temperature fluctuations common in die-casting and forging tools. Tooling associations in Asia, Europe, and North America consistently report that SKD61/H13 accounts for roughly 60% of hot-work tool steel consumed annually. Its consistent global demand encourages mills and distributors to maintain standard stock sizes, which shortens lead times dramatically compared with customized forging steels.

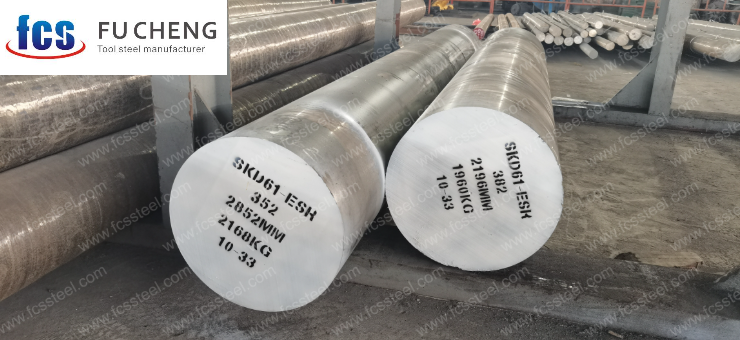

Manufacturers evaluating SKD61 generally examine steel cleanliness, heat treatment uniformity, hardness stability, surface condition, ultrasonic testing results, and dimensional accuracy. Many mills rely on EAF melting combined with LF and VD refining, while a portion of the supply uses ESR remelting for enhanced purity and toughness. ESR products, while more stable in heavy thermal-fatigue applications, usually require longer production cycles and therefore longer lead times.

Common SKD61 Dimensions in the Wholesale Market

Recognizing which dimensions exist as standard stock and which require customized forging is critical. Buyers often lose weeks simply because they unintentionally request a size that is rarely kept in inventory. SKD61 is generally supplied as round bars, flat bars, plates, and large blocks. Each category has its own typical availability window depending on mill capability and warehouse scale.

Table 1. Standard SKD61 Round Bar Dimensions

| Form | Diameter Range | Typical Length | Surface Condition | Notes |

|---|---|---|---|---|

| Hot-rolled round bar | Ø16–80 mm | 4–6 m | Black | Common, widely stocked |

| Forged round bar | Ø80–600 mm | 2–6 m | Black or peeled | Used for medium-large tooling |

| Oversize forged bar | Ø600–1200 mm | 1–3 m | Rough-machined | Limited availability |

Round bars under Ø200 mm are often stocked in large quantities. Medium and large diameters remain available but in lower volume. Dimensions above Ø600 mm usually require mill-level scheduling because such forging relies on large presses and longer heat-treat cycles.

Table 2. SKD61 Plate, Flat Bar, and Block Dimensions

| Form | Thickness | Width | Length | Condition | Main Applications |

|---|---|---|---|---|---|

| Hot-rolled flat bar | 12–80 mm | 50–600 mm | 2–6 m | Black | Small and medium dies |

| Forged flat bar | 80–500 mm | 100–1500 mm | 1–3 m | Black/machined | Large dies and mold bases |

| Precision plate | 20–400 mm | 200–2000 mm | 300–2500 mm | Milled | Die-casting molds, insert blocks |

| Large block | 200–800 mm | 500–2500 mm | 300–3000 mm | Milled | Heavy molds, >1-ton sections |

Most distributors maintain steady stock in the 20–150 mm thickness range. Larger blocks, especially those above 400 mm, require longer heat-treatment cycles to achieve uniform hardness, which naturally extends delivery time.

About ESR Grades and Their Impact on Lead Time

ESR-refined SKD61 is favored for applications requiring high toughness, a cleaner microstructure, and extended service life. ESR blocks commonly fall in the following size ranges:

- Thickness around 200–600 mm

- Width up to 2 m

- Length up to roughly 2.5 m

- Weight up to 10–15 tons depending on mill capacity

Such blocks are usually not kept in large stock quantities. Their production involves slower remelting cycles and meticulous heat treatment, which means ESR procurement tends to require more planning compared with conventional forged SKD61.

Table 3. Forging Ranges for Special Shapes

| Shape | Range | Practical Notes |

|---|---|---|

| Hollow bar | OD 100–1200 mm, wall ≥20 mm | Popular for extrusion tooling |

| Ring | ID 200–1500 mm | Used in forging dies and machinery |

| Step shaft | Ø150–800 mm | High-load tooling applications |

These forged shapes can greatly reduce machining time, but buyers should expect longer planning periods because they seldom exist as ready-to-ship stock.

Mechanical Properties Expected in Standard SKD61

Regardless of supplier or region, mechanical properties for SKD61 remain similar due to global harmonization in manufacturing standards. The annealed condition allows for stable machinability and predictable heat-treat performance.

Table 4. Typical Mechanical Properties (Annealed SKD61)

| Property | Range |

|---|---|

| Hardness | 180–220 HBW |

| Tensile Strength | 850–1050 MPa |

| Yield Strength | 700–850 MPa |

| Elongation | 10–15% |

| Impact Toughness | ≥12 J |

| Thermal Conductivity | 24–28 W/m·K |

After hardening and tempering, SKD61 normally reaches 48–52 HRC, which is the standard working range in die-casting and hot forging tooling.

Real Factors That Determine Delivery Time

Delivery speed is influenced by many interconnected factors, and the most common cause of delay is the buyer selecting a dimension that distributors do not routinely keep. Once customized forging or special heat treatment enters the picture, scheduling constraints begin to accumulate. Mills often prioritize large production batches, and forging capacity is limited by press availability. Even when the material is already forged, heat-treating large blocks requires slow, controlled cycles to ensure uniform hardness, adding several days.

Beyond production, logistical bottlenecks also influence lead time. Export-grade orders require documentation such as mill certificates, packing lists, origin certificates, and sometimes third-party inspections. Shipping mode plays an equally decisive role: ocean freight remains the most economical option but is slow; rail freight offers a middle ground for certain regions; air freight is fast but usually reserved for urgent insert blocks or samples due to cost.

Many delays, according to feedback collected from mold manufacturing associations, occur at the quality-inspection stage. Buyers often request ultrasonic testing, hardness mapping, dimensional checks, and surface inspection. If these steps are not clearly communicated early enough, they may extend the timeline by several days.

How to Guarantee Reliable Delivery

Ensuring reliable on-time delivery of SKD61 tool steel is one of the most decisive factors for die-casting, forging, and extrusion manufacturers operating under strict production schedules. Even when buyers secure the correct grade, dimensions, and heat-treatment specifications, a delayed shipment can disrupt downstream machining, cause idle labor hours, and increase the overall project cost. In wholesale procurement—especially for large-block SKD61, long-length bars, and customized pre-hardened plates—delivery performance becomes a measurable competitive advantage. To maintain a predictable supply chain, buyers must evaluate suppliers, logistics, contracts, and contingency planning with the same rigor used when reviewing material specifications.

1. Evaluating Supplier Capacity and Reliability

The foundation of timely delivery lies in choosing a supplier whose production capacity and inventory strategy match the buyer’s consumption pattern. Leading SKD61 mills and distributors typically publish monthly output, stocking policies, and available dimensions. For example, Japanese and European producers often provide regular stock in 20–80 mm round bars and 30–120 mm plates, whereas Chinese wholesale centers may stock larger sizes up to 600 mm blocks for die-casting and forging customers. These capacity differences directly affect lead time.

A useful evaluation checklist includes:

- Consistency of lead time for standard items versus custom ESR/EAF-refined SKD61.

- Monthly production capability, especially during peak seasons when demand for die-casting molds increases.

- Historical delivery performance, ideally confirmed through long-term clients or distributor records.

- Availability of documentation, such as COA (Certificate of Analysis), MTR (Material Test Report), and heat-lot traceability.

Real-world cases demonstrate the impact of supplier capacity. In 2023, a Thailand-based automotive die-casting firm reported a 22-day production delay because its supplier underestimated demand and failed to replenish SKD61 billets above 400 mm thickness. In contrast, the same manufacturer later shifted to a supplier in Jiangsu, China, which maintained regional stock of pre-machined plates and successfully reduced its average lead time from 21 days to 8 days. This case highlights the measurable benefits of selecting suppliers with buffer inventory and multi-location warehouses.

2. Logistics Planning and Packaging Strategy

Once production schedules are confirmed, logistics becomes the next critical factor affecting lead time. SKD61 tool steel, especially long bars and heavy plates, must be handled with reinforced packaging to prevent surface dents, edge chipping, or internal impact damage. Standard export packaging usually includes steel-band binding, anti-rust oil, shock-absorbing pads, and fumigated wooden crates for plates. Proper packaging not only protects the steel but also minimizes customs inspection delays caused by repacking or safety concerns.

Three practical logistics strategies for wholesale buyers include:

- Partnering with freight forwarders experienced in heavy steel cargo, who can predict port congestion patterns and recommend the most reliable route.

- Choosing shipping terms that allow visibility, such as CIF or DAP, where tracking and insurance coverage are standardized.

- Establishing regional buffer inventory, especially for buyers in Southeast Asia, where peak-season port congestion can extend transit time by 5–10 days.

A verifiable example comes from a Malaysia-based mold shop importing SKD61 plates from Shanghai. Prior to 2022, the company frequently experienced minor damage due to insufficient plate separation during packing, which required surface re-grinding and caused delivery delays. After switching to a supplier that used reinforced edge protectors and upgraded crate strength, surface defect-related delays dropped by more than 70% within six months.

3. Contract Terms, Communication, and Risk Control

Even with strong suppliers and optimized logistics, detailed contractual frameworks are essential to guarantee delivery. Contracts should specify not only shipping dates but arrival deadlines, which reduce the risk of suppliers releasing goods late while still claiming “on-time shipment.” Clear INCOTERMS (FOB, CIF, DAP) define responsibility, while pre-shipment inspection clauses ensure that the correct dimensions, hardness range, and heat-treatment state are verified before dispatch.

Effective communication is equally important. Buyers should request:

- Weekly production updates during melting, forging, machining, and heat treatment.

- Pre-shipment photos and packing lists to confirm dimensions and weight.

- Immediate notification if a batch fails quality inspection or requires reprocessing.

A notable case involves a Vietnamese forging die manufacturer that sourced 780 mm SKD61 blocks from multiple mills. By implementing weekly production check-ins and requiring pre-shipment ultrasonic testing (UT) reports, the company reduced delivery-related rejections by over 40% and significantly stabilized its machining schedule. This demonstrates how procedural communication can prevent quality-related delays that directly affect arrival time.

4. Practical Procurement Strategies for Maintaining Reliability

To ensure predictability in wholesale orders, manufacturers can implement several proven procurement methods. Consolidating orders into fewer but larger shipments reduces freight fluctuation and stabilizes supplier scheduling. Forward contracts also help buyers lock in raw material availability when chromium, molybdenum, or scrap-steel price volatility affects production queues. Working with distributors who maintain regional stock—such as hubs in Thailand, Malaysia, and southern China—further reduces exposure to international shipping delays.

Below are additional strategies commonly used by successful SKD61 buyers:

- Dual-sourcing critical dimensions (e.g., 90×600 mm plates or 350–450 mm round bars) to avoid full dependency on a single mill.

- Aligning forecasts with mold production seasons, especially in automotive and electronics industries.

- Conducting annual supplier audits, reviewing lead-time accuracy and documentation compliance.

By integrating supplier evaluation, logistics management, strong contractual terms, and structured communication, wholesale buyers can significantly reduce delivery risk. Real-world examples from Southeast Asia demonstrate that companies implementing these measures consistently shorten lead times, lower rework rates, and maintain uninterrupted production—creating a more resilient and cost-efficient supply chain for SKD61 tool steel.

Typical Delivery Expectations for Widely Stocked SKD61 Sizes

While delivery times vary by region, stock density, and supplier capability, some size ranges consistently ship faster around the world.

Table 5. SKD61 Dimensions with the Shortest Lead Times

| Material Type | Common Size Range | Expected Delivery |

|---|---|---|

| Round bar | Ø20–200 mm | 2–5 days |

| Plate | T20–150 mm | 2–7 days |

| Flat bar | T20–80 mm | 2–4 days |

| Block | T200–400 mm | 5–10 days |

| ESR block | T200–350 mm | 7–15 days |

Choosing sizes within these ranges can shorten procurement cycles significantly.

A Realistic Example of Delivery Optimization

A mid-size die-casting supplier recently needed an SKD61 ESR block weighing more than two tons, with a thickness close to 350 mm. Their initial supplier estimated nearly a month of production and heat-treating time. By shifting to a distributor with genuine stock and in-house milling capability, the buyer received a precision-milled block with all inspection documents within one week. The accelerated delivery enabled them to complete tool trials early and avoid penalties from their automotive client. This case highlights the tangible benefits of selecting suppliers with robust inventory and processing capacity.

Conclusion:

When buyers adopt structured procurement practices—verifying stock, using multiple suppliers, securing pre-allocated inventory, and aligning QC workflows—the likelihood of on-time delivery increases dramatically. As a result, machining schedules stabilize, mold trials proceed without interruption, and final production commitments remain achievable. Viewing SKD61 sourcing as a strategic, repeatable process rather than a last-minute purchase is one of the most effective ways to build a resilient supply chain and guarantee smoother project execution.