In global tooling and die-making industries, 1.2344 tool steel—internationally known for its hot-work performance—plays a critical role. It is relied upon for applications in die casting, hot extrusion, and forging because of its resistance to thermal fatigue, toughness, and durability. As demand for high-performance steels grows, buyers frequently compare China and Europe, two of the most influential regions in the steel manufacturing landscape.

This article explores the differences and advantages between Chinese and European 1.2344 tool steel manufacturers, offering buyers a comprehensive overview to inform procurement strategies. The comparison is not limited to cost but extends to quality assurance, customization capabilities, technological development, sustainability practices, and supply chain dynamics.

1. Market Position of China and Europe in 1.2344 Tool Steel

China’s Role in the Global Market

China is currently the largest steel producer in the world, and its role in the 1.2344 tool steel segment reflects that dominance. With massive production capacity, Chinese factories can deliver large batches at competitive pricing. The sheer scale of production also allows for flexibility in dimensions, treatments, and delivery schedules, a key advantage for buyers in fast-moving industries like consumer goods or automotive die-casting.

In addition, Chinese producers are increasingly aligning with international standards such as EN, ASTM, and JIS, ensuring that their products meet the requirements of global buyers. This shift has improved the global perception of Chinese 1.2344 tool steel, making it more competitive not only on cost but also on consistency.

Europe’s Role in the Global Market

Europe, in contrast, does not match China in production volume but is widely recognized for heritage, technical precision, and innovation in metallurgy. Facilities in countries such as Germany, Austria, and Sweden are often regarded as benchmarks for quality. European 1.2344 tool steel is associated with strict adherence to quality standards, cutting-edge R&D, and long service life of materials.

While European production costs are higher, buyers frequently associate this with premium quality, advanced sustainability practices, and guaranteed compliance with environmental and safety regulations. These attributes position European factories as preferred suppliers for industries requiring the highest performance standards, such as aerospace and high-end automotive tooling.

2. Cost Structure and Pricing Dynamics

Chinese Manufacturers: Cost Advantage

The most visible difference between China and Europe lies in cost competitiveness. Chinese factories benefit from:

- Economies of scale due to high production volumes.

- Lower labor costs compared to Europe.

- Government support policies for heavy industry and exports.

- Localized raw material availability, reducing some input costs.

For buyers procuring large volumes of 1.2344 tool steel, these factors combine to produce significantly lower per-ton pricing. This makes Chinese suppliers attractive to wholesalers, stockists, and industrial manufacturers seeking cost savings.

European Manufacturers: Value-Based Pricing

European suppliers operate with higher production costs due to labor expenses, energy prices, and stricter compliance regulations. However, their pricing model is less about cost competition and more about value addition. Buyers often accept higher upfront prices because of:

- Longer tool life, reducing replacement costs.

- Lower defect rates, improving efficiency.

- Comprehensive technical support, which minimizes trial-and-error expenses.

Thus, European manufacturers emphasize total cost of ownership (TCO) rather than unit cost, a perspective particularly relevant to industries with high downtime penalties.

3. Quality Assurance and Consistency

China’s Improvements in Quality Systems

Historically, one challenge with Chinese tool steels was the perceived inconsistency in quality. However, modern factories have significantly improved by adopting ISO-certified systems, third-party audits, and advanced refining technologies such as vacuum degassing. Many facilities now issue detailed mill test certificates (MTCs) and invite customer inspections.

Consistency remains a priority for global buyers, and Chinese factories are increasingly able to demonstrate stable metallurgical properties across large batches, narrowing the gap with European suppliers.

Europe’s Established Quality Reputation

European factories, by contrast, are known for their uncompromising commitment to quality assurance. Production processes are often more automated, and quality control integrates:

- Tighter tolerance ranges for chemical composition.

- Advanced non-destructive testing (NDT) to detect micro-defects.

- Detailed traceability systems from raw material to final product.

European manufacturers often set the benchmark in steelmaking precision, which explains why industries with extreme performance demands, such as aerospace forging dies, frequently rely on European 1.2344 suppliers despite higher prices.

4. Technical Expertise and R&D Support

Technical Capabilities in China

Chinese manufacturers are no longer purely cost-driven producers. Many have developed in-house metallurgical teams capable of providing:

- Guidance on hardness ranges suitable for die-casting or extrusion.

- Customized heat treatment cycles.

- Suggestions for alternative grades like D2 ,H13,or SKD61 in complementary applications.

Factories in major industrial zones are increasingly engaging in collaborative R&D projects, supporting buyers in sectors like automotive die-casting and electronics mold manufacturing.

Technical Leadership in Europe

Europe continues to lead in research and innovation. Many factories collaborate with universities and research institutes to develop advanced alloys and improve hot-work steel performance. Areas of expertise include:

- Thermal fatigue resistance improvements through alloy adjustments.

- Surface treatment innovations like nitriding or PVD coatings.

- Sustainability-driven metallurgy, with focus on low-carbon steelmaking.

European R&D leadership ensures their steel often demonstrates extended tool life and reduced maintenance cycles, giving buyers a clear technical edge.

5. Customization and Production Flexibility

Flexibility in China

Chinese factories are highly responsive to customization requests. Buyers can request:

- Non-standard dimensions.

- Specific hardness ranges.

- Semi-finished or pre-machined blocks.

- Adjusted rolling schedules for urgent orders.

Because of their scale and adaptability, Chinese suppliers excel at fulfilling high-volume custom orders quickly, making them an excellent choice for industries with fluctuating demand.

Precision in Europe

European manufacturers also provide customization, but with a stronger emphasis on precision and niche requirements. Instead of speed, they focus on meticulous adherence to specifications, ensuring exact compliance with industry norms. This approach is especially valued in applications where tolerance for error is minimal, such as aerospace or energy-sector tooling.

6. Supply Chain, Logistics, and Delivery

Logistics Strength in China

China’s infrastructure and export-oriented logistics networks allow for competitive shipping options, including sea and air freight. Many factories maintain large inventories to support quick turnaround, making them suitable for international buyers seeking shorter lead times despite geographical distance.

European Proximity Advantage

For buyers within Europe, sourcing locally offers a distinct advantage in delivery speed and reduced shipping costs. European factories can deliver within days or weeks, whereas shipments from Asia may take longer despite streamlined logistics. This makes European suppliers strategically beneficial for urgent or just-in-time procurement needs.

7. Sustainability and Certification

China’s Growing Focus on Sustainability

Chinese factories are increasingly adopting eco-friendly practices, such as higher scrap utilization, improved energy efficiency, and compliance with ISO 14001 standards. Although challenges remain, the trajectory is clearly toward greener production models.

Europe’s Environmental Leadership

European steelmakers are global leaders in sustainable metallurgy, investing heavily in low-carbon technologies and aligning with strict EU climate targets. For buyers prioritizing sustainability, European factories offer stronger alignment with corporate ESG goals.

8. Strategic Considerations for Buyers

When deciding between Chinese and European 1.2344 tool steel manufacturers, buyers must align their choices with business priorities:

- Cost-sensitive buyers (wholesalers, distributors, large-volume manufacturers) often benefit more from China’s scale and pricing advantage.

- Quality-sensitive buyers (aerospace, high-performance tooling) may prefer Europe’s established precision and innovation edge.

- Balanced strategies may involve sourcing both from China for bulk orders and Europe for niche, high-performance applications.

Promotional Section: Partnering with FCS Tool Steel Factory

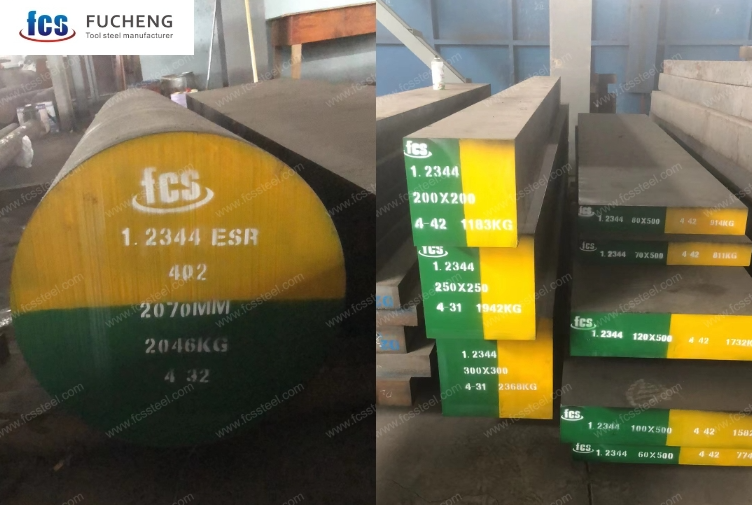

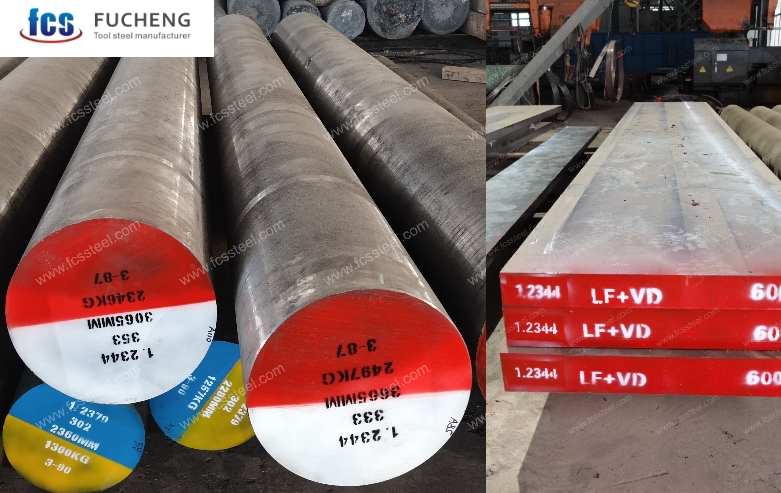

When global buyers weigh their options, one solution that combines cost-effectiveness with technical reliability is to partner with FCS Tool Steel Factory (also known as Fucheng Tool Steel). Unlike intermediaries, FCS operates as a direct producer, offering competitive 1.2344 tool steel backed by consistent quality assurance and export-focused service.

What sets FCS apart is its ability to balance scale with customization. Buyers can secure large volumes of 1.2344 alongside grades like D2 or H13, while still requesting specific heat treatments, tailored hardness ranges, and surface preparation. For wholesalers and stockists, FCS’s ready inventories and reliable shipping translate into minimized downtime and stronger competitiveness.

If your goal is to secure a stable, long-term partner for 1.2344 tool steel sourcing, FCS Tool Steel Factory is ready to deliver solutions that match both cost expectations and global standards.

Conclusion

The comparison between Chinese and European 1.2344 tool steel manufacturers highlights two complementary strengths. China dominates with cost efficiency, scalability, and flexible customization, making it attractive for buyers focused on bulk supply and competitive pricing. Europe excels with precision, innovation, and sustainability, offering unmatched performance for industries with zero tolerance for quality issues.

For global procurement managers, the key lies in identifying which advantages align most closely with business needs. In many cases, an integrated strategy that leverages both regions proves most effective. Regardless of the chosen path, understanding the unique strengths of China and Europe ensures smarter sourcing decisions—and a more resilient supply chain in today’s competitive tool steel market.