The global tool steel market in 2025 continues to experience volatility driven by alloying elements, energy costs, trade policies, and fluctuating demand from die-casting and forging industries. Among hot-work tool steels, 1.2344 (H13 equivalent) remains one of the most widely consumed grades in Europe and Asia, especially in Germany, Italy, Sweden, and China.

For procurement managers in these regions, monitoring spot vs long-term contract prices is essential. Spot purchases provide flexibility but expose buyers to market swings, while contracts offer price stability at the cost of volume commitments.

This article analyzes the key factors influencing 1.2344 steel pricing in 2025, compares regional spot and contract ranges, and offers practical strategies for cost optimization.

1. Key Factors Driving 1.2344 Steel Prices in 2025

Several global and regional factors influence the cost of producing and distributing 1.2344:

1.1 Alloying Elements (Cr, Mo, V)

- Molybdenum (Mo): Prices rose in early 2025 due to supply tightening from South America. Mo is critical for hot-hardness in 1.2344, so price volatility directly impacts costs.

- Chromium (Cr): Stable supply from South Africa and Kazakhstan, but subject to EU carbon adjustment mechanisms.

- Vanadium (V): Moderate increases tied to demand from aerospace alloys.

1.2 Energy and Power Costs

- Germany & Italy: Higher electricity and natural gas prices due to EU’s energy transition policies.

- Sweden: Hydropower and nuclear base lead to relatively lower industrial electricity rates.

- China: Regional variations — eastern provinces face higher tariffs vs inland steel hubs.

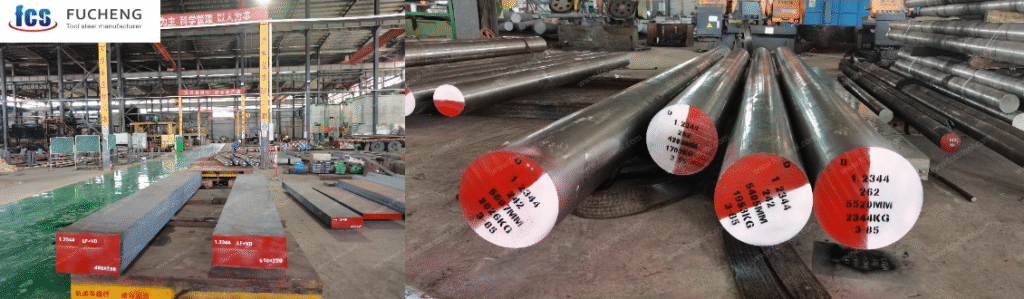

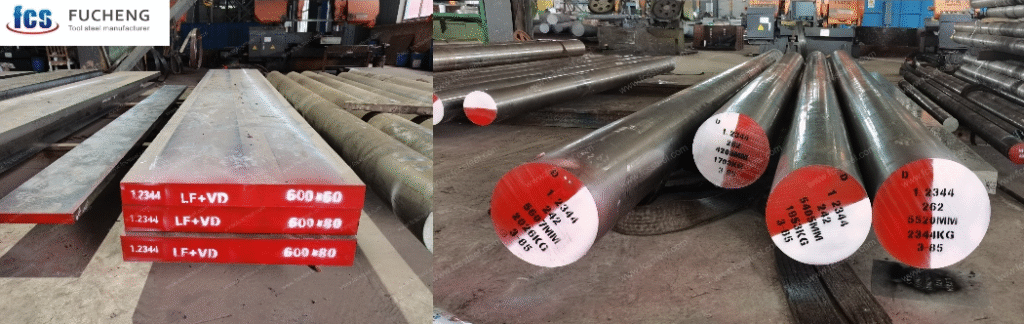

1.3 Furnace Technology and Refining Process

- Electric Arc Furnace (EAF) with vacuum refining increases cost but improves purity.

- German and Swedish mills emphasize ESR/VAR remelting, raising prices but ensuring better tool life.

- Chinese producers offer more standard EAF 1.2344, making their prices more competitive.

1.4 Logistics and Tariffs

- EU Market: Internal trade within Europe is tariff-free, but imports from China face anti-dumping duties (up to 25%).

- China: Export pricing often competitive, but freight costs fluctuate with global container demand.

1.5 Inventory and Demand Cycles

- Germany/Italy: High automotive demand keeps stock tight.

- Sweden: Toolmakers maintain leaner inventories, relying on stable contract supply.

- China: Abundant spot availability, but export quotas and customs rules can delay shipments.

2. Regional Spot vs Contract Price Ranges (2025)

⚠️ Data Note: The ranges below are based on publicly available industry price indices and market quotation ranges, and are provided for reference only. Actual procurement prices shall be determined according to real-time quotations from steel mills/traders.

| Region | Spot Price (USD/ton) | Contract Price (USD/ton, 6–12 months) | Notes |

|---|---|---|---|

| Germany | 3,200 – 3,600 | 3,000 – 3,300 | Higher due to ESR/VAR refining; stable contracts reduce volatility. |

| Italy | 3,100 – 3,500 | 2,950 – 3,250 | Influenced by energy surcharges; contract buyers benefit from discounts. |

| Sweden | 3,300 – 3,700 | 3,050 – 3,350 | Premium quality focus; long-term contracts common among press tool makers. |

| China | 2,600 – 2,900 | 2,450 – 2,700 | More competitive pricing; anti-dumping tariffs raise landed cost in EU. |

Analysis:

- Spot prices are typically 10–15% higher than long-term contract prices.

- EU buyers face additional costs from carbon and energy surcharges, while China offers base steel at lower ex-works prices but with logistics/tariff risks.

3. Spot vs Contract: Which Option Fits Buyers Best?

Spot Purchases

Pros

- Flexibility for small or urgent orders.

- Ability to capitalize on short-term price dips.

- No long-term commitment.

Cons

- Exposure to price spikes from alloy or energy shocks.

- Limited availability during peak demand (e.g., automotive surge).

Long-Term Contracts

Pros

- Price stability and predictability.

- Potential discounts for volume commitments.

- Better supplier relationship and priority allocation.

Cons

- Less flexibility if demand declines.

- Risk of locking into higher prices during downward cycles.

4. Cost-Saving Procurement Actions

To optimize steel sourcing in 2025, regional buyers can implement the following procurement strategies:

4.1 Alloy Hedging

- Secure forward contracts for Molybdenum and Chromium when prices are low.

- Work with suppliers offering alloy surcharge adjustment clauses.

4.2 Mixed Sourcing Strategy

- Combine spot purchases for flexibility with long-term contracts for core volumes.

- Example: Secure 70% of annual demand via contract, 30% via spot.

4.3 Logistics Optimization

- EU buyers importing from China should calculate landed cost including tariffs, VAT, and freight.

- Negotiate bulk shipping rates or collaborate with freight forwarders.

4.4 Supplier Diversification

- Germany/Italy: Consider sourcing partial volumes from Sweden to offset energy-related premiums.

- EU + China hybrid sourcing: leverage China for base demand, EU for critical tooling.

4.5 Inventory Management

- Use demand forecasting tools to avoid overstocking during price peaks.

- Align procurement cycles with seasonal automotive production trends in Europe.

5. Practical Checklist for Procurement Teams

Cost-Saving Procurement Checklist for 1.2344 Steel (2025):

- Secure long-term contracts for at least 60–70% of core demand.

- Hedge alloy surcharges (Mo, Cr) when global prices dip.

- Use spot market for urgent or opportunistic buys.

- Calculate full landed costs (tariffs, logistics, energy surcharges).

- Evaluate supplier’s furnace technology (ESR vs standard EAF) for tool life ROI.

- Maintain at least 2 regional supplier relationships (EU + Asia).

- Monitor EU’s Carbon Border Adjustment Mechanism (CBAM) impacts on imports.

Conclusion

In 2025, 1.2344 steel prices across Germany, Italy, Sweden, and China are shaped by a complex mix of alloy costs, energy markets, refining technologies, logistics, and policy factors.

- Germany & Sweden: Higher prices, but premium ESR/VAR quality ensures longer die life.

- Italy: More energy-sensitive, but competitive for regional buyers.

- China: Lower base price, yet subject to tariffs and freight volatility for EU importers.

For procurement managers, the optimal strategy lies in balancing spot and contract purchases, combined with alloy hedging and supplier diversification. By adopting a structured procurement approach, manufacturers can stabilize costs, reduce risks, and ensure reliable supply in a volatile 2025 market.