The tool steel industry plays a critical role in South Korea’s advanced manufacturing ecosystem. Among the different grades available, 1.2344 tool steel—also known as H13 in the American standard—is a widely used hot-work tool steel, favored for its exceptional toughness, thermal fatigue resistance, and durability in demanding applications. As 2025 approaches, many industry professionals are eager to understand how global and domestic factors will shape the price trends of 1.2344 tool steel in South Korea.

This article explores the current market dynamics, cost drivers, expected outlook for 2025, and key industry data that help wholesalers, distributors, and manufacturers make informed purchasing decisions.

Current Market Landscape in South Korea

South Korea has a strong reliance on imports for specialty steels, including 1.2344. According to Korea Iron & Steel Association (KOSA), over 65% of high-grade tool steels are imported, with China, Japan, and Europe being the primary sources.

As of Q4 2024, the average price of 1.2344 tool steel in South Korea hovered around $3,200–$3,400 per metric ton, depending on form (flat bar, round bar, or blocks) and quality (conventional or ESR refined). The rising demand from sectors like automotive mold making and aerospace forging has kept consumption steady, even amid global alloy price fluctuations.

Key Price Drivers for 2025

Several factors are expected to influence 1.2344 tool steel prices in South Korea during 2025:

1. Raw Material Costs

The prices of chromium, molybdenum, and vanadium—key alloying elements—have shown volatility in recent years. For example, molybdenum prices increased by nearly 28% in 2024, primarily due to limited global supply and higher energy costs in mining. Since 1.2344 contains significant amounts of molybdenum, further fluctuations in alloy prices will directly affect its cost.

2. Energy and Production Costs

South Korea’s steel industry is energy-intensive. With electricity prices forecasted to increase by 5–7% in 2025 due to rising LNG import costs, local processing and distribution expenses may also rise.

3. Exchange Rate Volatility

The KRW/USD exchange rate is a key determinant since most imports are priced in dollars. In 2024, the Korean won depreciated by around 6% against the USD, making imports more expensive. If this trend continues in 2025, domestic buyers should expect higher landed costs.

4. Industrial Demand

South Korea’s tool steel consumption is tied closely to its manufacturing industries. The automotive sector alone accounts for nearly 32% of tool steel demand, with increasing requirements for die casting and forging tools. With Korean EV exports projected to grow by 15% in 2025, the demand for durable hot-work steels like 1.2344 is expected to rise.

Projected Price Outlook for 2025

Based on current data and global forecasts, the price of 1.2344 tool steel in South Korea is expected to remain in the range of $3,300–$3,600 per ton in 2025, with ESR (Electro-Slag Remelted) variants potentially reaching $3,800 per ton due to superior quality and refining costs.

Best-Case Scenario: If alloy prices stabilize and the KRW strengthens, prices could remain near the lower end of the range (~$3,200–$3,300).

Worst-Case Scenario: Continued currency depreciation and alloy shortages could push prices above $3,700 per ton.

For wholesalers and distributors, locking in supply contracts early in the year could mitigate risks from price volatility.

Global Market Comparison for 1.2344 Tool Steel

While South Korea is a major importer, it is important to benchmark against global market prices:

- China: The world’s largest tool steel producer, with 1.2344 prices averaging $2,800–$3,000/ton. Lower production costs give Chinese suppliers a price advantage, though quality may vary across mills.

- Europe: European ESR-grade 1.2344 is among the highest-priced, reaching $3,900–$4,100/ton due to stricter environmental standards and high energy costs.

- United States: U.S. prices for 1.2344 averaged $3,600/ton in late 2024, driven by domestic demand in aerospace and oil & gas toolmaking.

- This comparison highlights that South Korea’s 2025 price range (~$3,300–$3,600/ton) is competitive regionally but more aligned with the U.S. market than with lower-cost Chinese imports. Buyers should weigh quality, delivery time, and after-sales service when making sourcing decisions.

Strategic Insights for Buyers

For buyers, here are some strategies to navigate the 2025 market:

- Diversify Suppliers: Relying solely on imports from one region increases exposure to supply risks.

- Monitor Currency Trends: Importers should watch the KRW/USD exchange closely and consider hedging.

- Prioritize ESR Grades: While more expensive, ESR 1.2344 steel offers longer tool life and reduced downtime, which can lower overall production costs.

FCS Tool Steel: Your Trusted Source for 1.2344

For companies looking to secure a reliable source of 1.2344 tool steel, FCS Tool Steel Factory stands out as a global supplier with proven expertise.

Factory Background: FCS (Fucheng Tool Steel) has decades of experience in tool steel production and has built long-term partnerships with wholesalers, stockists, and traders worldwide.

Product Advantages:

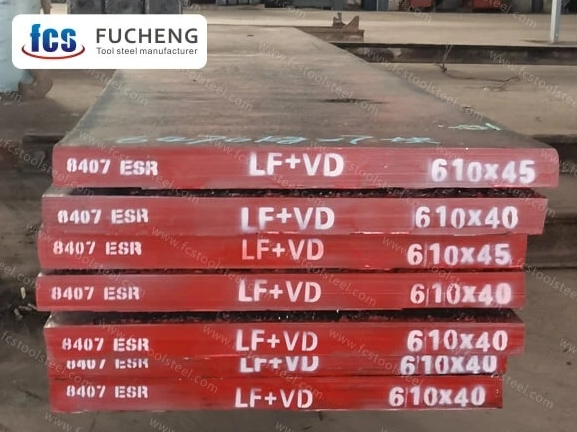

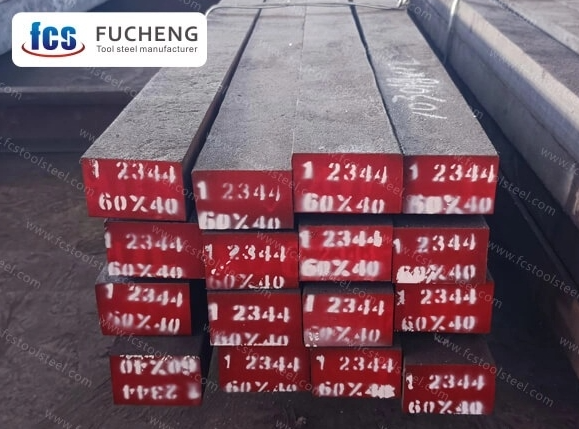

- Availability of both conventional and ESR 1.2344 steel.

- Standard supply forms include flat bars, round bars, and forged blocks, with customizable dimensions.

- Consistent mechanical properties that meet DIN, ASTM, and JIS standards.

Competitive Edge: With an integrated supply chain, FCS offers competitive bulk pricing, short lead times, and global logistics support, making it a preferred choice for international buyers.

For South Korean importers seeking to balance quality with cost efficiency, sourcing from FCS ensures stability and performance in every shipment.

Conclusion

The outlook for 1.2344 tool steel prices in South Korea for 2025 indicates steady but cautious growth, influenced by global alloy trends, energy costs, and industrial demand. With projected prices ranging between $3,300 and $3,600 per ton, stakeholders must adopt proactive strategies to secure supply and manage risk.

By choosing trusted suppliers such as FCS Tool Steel Factory, buyers can ensure access to high-quality 1.2344 steel at competitive rates, positioning their businesses for success in an evolving market.