Introduction:

Ever bought steel that looked great on paper but cracked under real pressure? The global 1.2316 market has too many suppliers. They all promise rust resistance. Yet many sell material that fails its first PVC cycle. Price tags hide the truth. You can’t tell if the molybdenum content is real. You can’t see if the refining process took shortcuts. Pick the wrong source and you lose more than money. Production lines can stop for weeks. Most procurement teams miss key details during quote comparisons across continents.

China: The Global Engine of Volume and “Modified” Grades

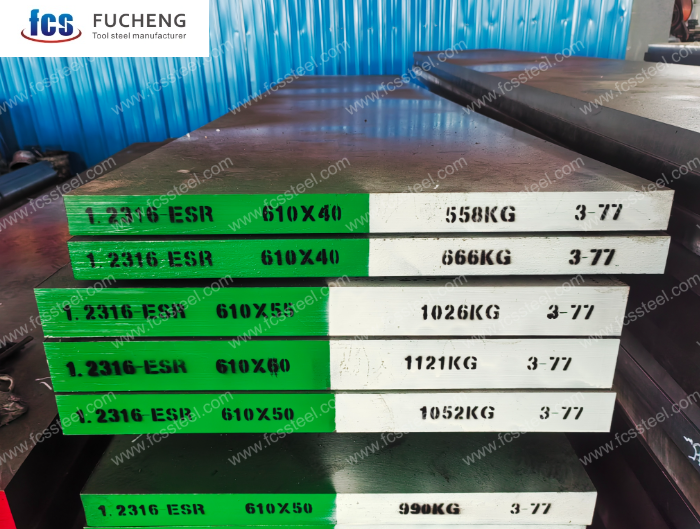

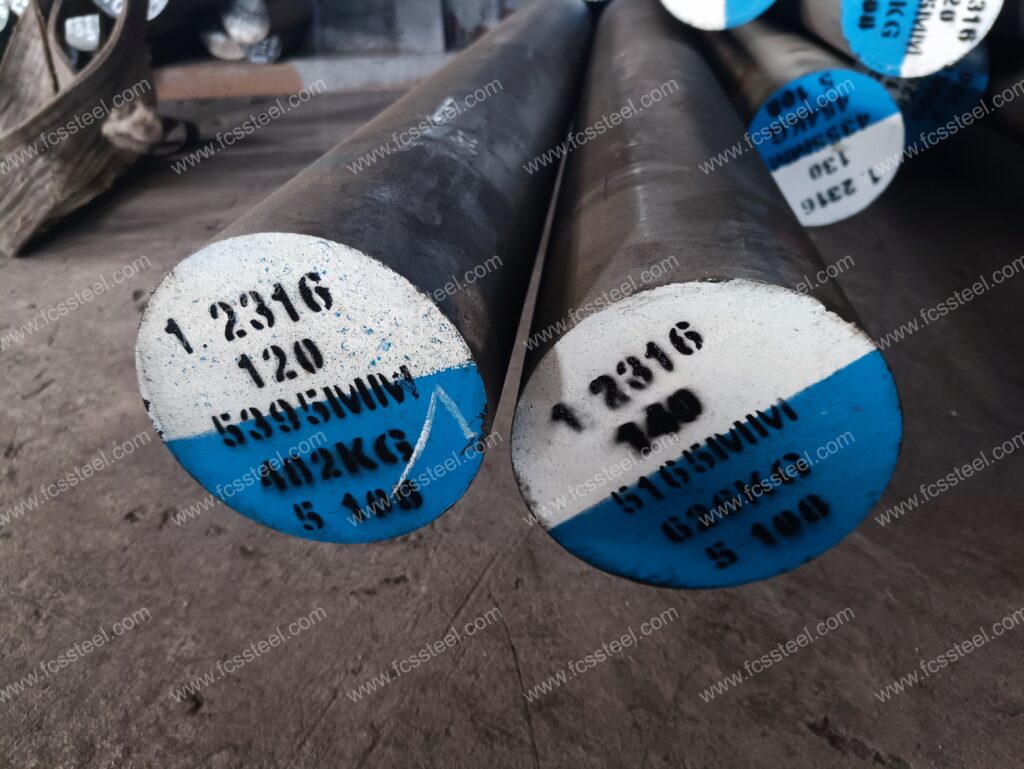

China currently controls over 60% of the global wholesale market for 1.2316 steel, led by giants like Fucheng Tool Steel (FCS).The core competitiveness here is the unmatched scale and “direct-to-buyer” pricing.

Pros: Wholesale pricing is the most competitive worldwide, ranging from $2,600 to $3,300 per ton (FOB). The availability of “Bright Milled” blocks is massive, allowing buyers to skip rough machining.

Cons: High risk of center-line segregation in blocks exceeding 400mm. You must be vigilant about verifying the refining route.

Case Study: A Tier-2 automotive supplier in Mexico sourced 40 tons of Chinese 1.2316 for a PVC door-seal mold. By specifying LF+VD (Ladle Furnace + Vacuum Degassing) refining, they achieved a tool life of 800,000 cycles at 45% less cost than European alternatives.

Main Export Sectors: Consumer electronics (laptop frames), domestic appliances, and massive infrastructure projects (PVC pipe fittings).

Germany & Austria: The “Mirror Finish” Gold Standard

When a project demands “Optical Grade” surfaces, the “Old Master” always looks to BÖHLER (M303) or Buderus Edelstahl. They do not just sell steel; they sell metallurgical purity.

Pros: Their ESR (Electroslag Remelting) technology is the world benchmark. Sulfur levels are often kept below 0.003%, ensuring that the steel matrix is so clean it behaves like glass under a polishing wheel.

Cons: Eye-watering prices ($6,000–$8,500 per ton) and rigid lead times that often exceed 14 weeks.

Case Study: A Swiss medical manufacturer producing insulin pen components switched from standard stainless to BÖHLER M303. They reduced mold-polishing time by 60% because the ESR steel eliminated the “pitting” and “orange peel” effects that previously required manual rework.

Main Export Sectors: Medical devices (surgical inserts), high-end cosmetics packaging, and VR/AR optical lenses.

Japan: The Specialists in Dimensional Stability

Japanese mills like Daido Steel (S-STAR) and Proterial (HPM38) have built their reputation on “Predictability.” In the micro-precision world, Japanese steel is the king of low-warpage.

Pros: Exceptional stability during vacuum heat treatment. The hardness uniformity across a 300mm block is typically kept within ±1 HRC.

Cons: Distribution is often tightly controlled by authorized regional stockists, making it harder for new wholesale buyers to negotiate direct mill deals.

Case Study: A Japanese camera module maker used Daido S-STAR for a 128-cavity smartphone lens mold. The steel’s thermal stability ensured that all 128 cavities remained within a 3-micron tolerance after quenching—a feat rarely achieved with budget grades.

Main Export Sectors: Precision electronics, smartphone lens modules, and high-speed automotive sensors.

Southeast Asia (Vietnam & Thailand): The Emerging Service Hubs

Thailand and Vietnam have transitioned from consumers to major Value-Add exporters, acting as the “China Plus One” strategic alternative.

Pros: These regions offer significant tariff advantages for North American and European buyers. They excel in providing Pre-hardened (30-36 HRC) near-net-shape blocks.

Cons: Limited heavy smelting capacity; they often rely on imported ingots from China or Japan to perform their final forging and heat treatment.

Case Study: A footwear mold manufacturer in the US shifted their wholesale orders to a Vietnamese stockist. By purchasing pre-machined 1.2316 blocks, they avoided 25% “Section 301” tariffs and reduced their internal CNC roughing time by 30 hours per mold.

Main Export Sectors: Footwear molds, stationery, and regional construction gear.

Head-to-Head Comparison: Global 1.2316 Sourcing Data

| Feature | China (Wholesale) | Germany / Austria | Japan (Precision) | SE Asia (Service) |

| Price (USD/Ton) | $2,600 – $3,300 | $6,000 – $8,500 | $4,500 – $5,500 | $3,200 – $4,200 |

| Sulfur (S) Level | 0.005 – 0.015% | < 0.003% | < 0.005% | 0.005 – 0.010% |

| Polishability | Industrial Mirror | A-1 Optical Grade | A-2 High Gloss | Industrial Grade |

| Lead Time | 4 – 6 Weeks | 12 – 16 Weeks | 8 – 10 Weeks | 4 – 8 Weeks |

| Core Advantage | Cost & Capacity | Extreme Purity | Low Deformation | Tariff-Free/Service |

Final Sourcing Strategy

As a buyer, you must match the “Pedigree” of the steel to the “Destiny” of the mold. Don’t buy German ESR for a disposable toy mold, and don’t buy budget VD steel for a surgical instrument.

- Demand the MTR: Always verify the Molybdenum (Mo) content. If it is below 0.8%, it is not a true 1.2316 and will not withstand PVC corrosion.

- Verify the UT: Demand SEP 1921 Class 3 Grade D/d ultrasonic testing. This ensures there are no internal “voids” hiding in your wholesale blocks.

- Check the Hardness Map: Ask for a 5-point hardness check (corners and center). If the variance is more than 3 HRC, the quenching was uneven, and the steel will warp during machining.

The Master’s Bottom Line: In the tool steel game, “Cheap” can become “Catastrophic” overnight. Use the global data to balance your budget, but never compromise on the chemistry.

Summary

Success in sourcing 1.2316 steel is about matching the pedigree of the metal to the destiny of the mold. China is for volume, Germany for purity, and Japan for precision. Never compromise on chemistry for a discount; the most expensive steel is the one that fails mid-production. I remember a factory in Suzhou shutting down for a week because a single batch of off-spec steel warped at high temperature—production halted, contracts delayed, all because the numbers on the certificate didn’t match what was inside. About 72% of procurement managers surveyed agree: quality shortcuts become costly regrets.