The tool steel industry serves as the backbone of advanced manufacturing sectors, from automotive and aerospace to electronics and energy. Among the numerous grades, 1.2344 tool steel—often cross-referenced with H13 hot-work tool steel—remains a global workhorse material. Its resilience under thermal fatigue, toughness in hot-working conditions, and adaptability for die casting, extrusion, and forging have made it indispensable in both Europe and Asia. Over the past decade, however, demand patterns have shifted due to evolving industrial landscapes, sustainability initiatives, and competitive pressures.

This article explores these changes through six key lenses: demand drivers in Europe and Asia, quantitative insights from European markets, focal points in Asia, global growth predictions for tool steels, major challenges, and a comparative evaluation of regional dynamics.

Demand Drivers in Europe and Asia

Demand for 1.2344 tool steel is shaped by macroeconomic conditions, industrial specialization, and regulatory frameworks. Both Europe and Asia are significant consumers, but their drivers differ.

Europe: Mature Industries With Specialized Needs

- Automotive and Mobility: Europe’s strong automotive sector, centered in Germany, France, and Italy, is one of the largest end-users. Hot-work tool steel is critical for die-casting aluminum components, extrusion dies for lightweight frames, and forging tools for high-strength steel parts.

- Aerospace and Defense: European aerospace producers require 1.2344 for turbine blade casting and high-pressure die casting of lightweight alloys. Tighter EU sustainability goals encourage lightweighting, further fueling reliance on hot-work steels.

- Green Transition Manufacturing: Investments in renewable energy and electric vehicle platforms demand advanced molds, where 1.2344’s thermal stability supports new component designs.

Asia: Growth Through Scale and Expansion

- Automotive Growth in Asia-Pacific: China, India, Japan, and South Korea are major contributors. Asia not only produces for domestic consumption but also exports parts globally. The surge in electric vehicle (EV) manufacturing further boosts demand for precise and heat-resistant molds.

- Electronics and Consumer Goods: Precision molds for plastic housings, connectors, and semiconductor-related components often use 1.2344 in hybrid mold designs due to its ability to endure repeated high-temperature injection cycles.

- Infrastructure and Heavy Machinery: Emerging economies in Southeast Asia have increased demand for forging and extrusion tools, particularly in steel-intensive projects.

In short, while Europe’s demand is tied to innovation, regulation, and high-value applications, Asia’s demand is increasingly driven by volume growth, expanding middle-class consumption, and industrial diversification.

Key Data on the European Market

Quantifying demand for 1.2344 requires examining steel consumption in toolmaking industries, as well as the broader mold steel market.

- Market Volume: Europe consumes a significant share of the global tool steel output, with Germany accounting for the largest proportion. Estimates suggest the EU’s demand for hot-work tool steels, including 1.2344, has stabilized around 20–25% of global consumption.

- Sector Distribution: Within Europe, automotive applications account for over 40% of hot-work steel demand, followed by aerospace, die casting for non-ferrous metals, and energy equipment.

- Growth Rate: European demand for 1.2344 is stable but slow-growing, projected at around 1.5–2% CAGR. This modest growth contrasts with higher expansion rates in Asia but reflects Europe’s emphasis on quality, process efficiency, and environmental compliance.

- Supply Mix: Most European countries rely on a combination of domestic production and imports. For example, Central and Eastern Europe depend heavily on imported billets and blocks, while Western Europe maintains robust local tool steel industries.

- Sustainability Influence: With the EU’s Carbon Border Adjustment Mechanism (CBAM) and stringent environmental policies, tool steel producers are pressured to decarbonize. Buyers increasingly require assurance of lower emissions per ton of steel, which may affect sourcing decisions.

Overall, the European 1.2344 tool steel market is characterized by mature, regulated demand, leaning toward technological refinement rather than sheer volume growth.

Asia’s Market Focus

Asia’s markets present a different picture: rapid expansion, infrastructure-driven consumption, and a blend of domestic manufacturing powerhouses with export-oriented industries.

China

- The largest global consumer of hot-work tool steel, China has an outsized influence on 1.2344 demand.

- Growth stems from die-casting in the automotive sector, especially aluminum casting for EV batteries and body structures.

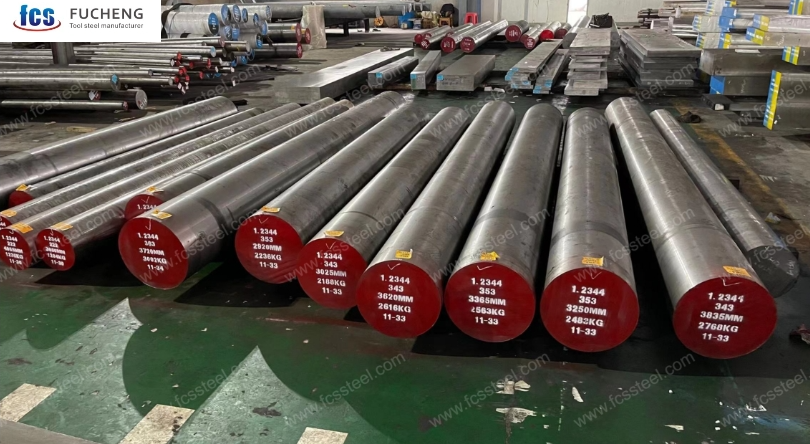

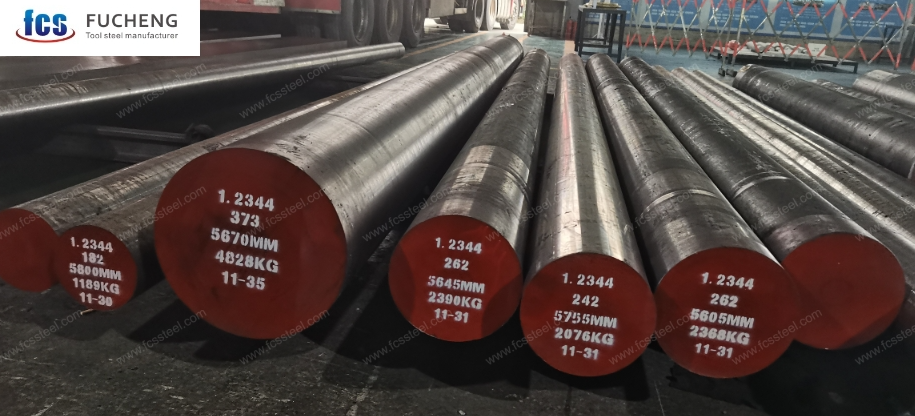

- Domestic supply chains have scaled up to reduce dependence on imports, yet international buyers still turn to Chinese producers for cost efficiency and batch supply capacity.

Japan

- Japan’s demand for 1.2344 reflects its precision manufacturing ethos. Aerospace, robotics, and high-end automotive components rely on top-tier quality hot-work steels.

- Japanese firms prioritize consistency, cleanliness, and precision machining properties, often requiring ESR (electroslag remelted) versions of 1.2344.

India

- India’s tool steel market is rapidly expanding, driven by government-led initiatives in automotive and infrastructure.

- Forging dies and extrusion dies for large-scale construction equipment heavily utilize 1.2344.

- With “Make in India” policies, local tool steel demand is expected to grow at over 6% CAGR through 2030, outpacing global averages.

Southeast Asia

- Countries like Thailand, Vietnam, and Indonesia have become emerging hubs for consumer goods and electronics assembly.

- Precision molds for plastics and aluminum components increasingly specify 1.2344, imported mainly from regional suppliers.

In contrast to Europe, Asia’s demand is characterized by volume expansion, more frequent upgrades of molds due to high production intensity, and diversification across multiple industries.

Global Mold Steel Market Growth Forecast

To understand the outlook for 1.2344, it helps to place it within the wider mold steel sector.

- Market Size: The global tool steel market is valued in the tens of billions USD, with hot-work steels like 1.2344 accounting for a substantial share.

- Projected Growth: Forecasts suggest the global mold/tool steel sector will grow at approximately 4–5% CAGR through 2032, with Asia-Pacific leading at growth rates above 6%. Europe is projected to remain stable, while North America shows modest expansion at around 2–3%.

- Application Segments:

- Die Casting: One of the fastest-growing applications, tied to aluminum and magnesium demand in lightweighting strategies.

- Extrusion: Used for profiles in construction, transport, and machinery.

- Forging: Essential for high-strength automotive and aerospace parts.

- Influence of EVs: Electric vehicle manufacturing, both in Europe and Asia, will continue to drive mold steel consumption. The complexity of battery housings, cooling systems, and lightweight structures places greater reliance on 1.2344’s hot-strength performance.

- Technology Influence: ESR and VAR (vacuum arc remelting) processes are becoming more standard, especially for aerospace-grade demand. Factories investing in these technologies are better positioned to capture premium market segments.

Thus, globally, demand for 1.2344 is poised to grow, but the strongest expansion will remain concentrated in Asia.

Challenges in European and Asian Markets

While demand is strong, both regions face distinct challenges.

Europe

- High Production Costs: European tool steel production is burdened by high labor, energy, and compliance costs. This raises the price per ton of 1.2344 relative to Asian sources.

- Sustainability Regulations: While necessary, the EU’s environmental regulations increase complexity and cost for producers. Factories must invest in low-carbon processes, recycling, and traceability.

- Aging Infrastructure: Some European steel mills struggle with older equipment, requiring modernization to stay competitive in quality-sensitive markets.

Asia

- Overcapacity Risks: With many countries expanding production, oversupply could pressure margins, particularly for standard-grade 1.2344.

- Quality Variability: Not all suppliers meet the same metallurgical standards. Buyers must vet suppliers carefully to avoid inconsistency in hot-strength and fatigue resistance.

- Geopolitical and Trade Tensions: Regional disputes, tariffs, and trade restrictions may disrupt cross-border supply chains.

- Environmental Transition: As Asian economies adopt stricter emissions targets, steelmakers must balance rapid growth with cleaner processes.

Despite these challenges, demand in both regions remains resilient, highlighting the strategic value of 1.2344 tool steel.

Comparative Features of European and Asian Markets

When comparing the two regions, distinct contrasts emerge.

| Feature | Europe | Asia |

|---|---|---|

| Demand Nature | Mature, specialized, regulation-driven | Expansive, high-volume, growth-driven |

| Primary Sectors | Automotive (lightweighting), aerospace, renewable energy | Automotive (EVs), electronics, infrastructure |

| Growth Rate | 1.5–2% CAGR | 5–6% CAGR |

| Quality Expectation | High precision, ESR/VAR focus, strict standards | Broad range: from commodity to high-end ESR |

| Challenges | High costs, sustainability mandates, slower modernization | Overcapacity, quality variation, geopolitical trade risks |

| Future Outlook | Stable demand with innovation-driven niches | Strong expansion with diversified industrial base |

The comparison underscores a key strategic insight: Europe is about high-value specialization, while Asia is about volume and scale. Multinational buyers often balance their sourcing by combining European high-precision suppliers with Asian high-volume producers to hedge both cost and performance requirements.

Conclusion

The demand for 1.2344 tool steel(H13 tool steel) in Europe and Asia illustrates two very different yet complementary industrial narratives. Europe remains a center for advanced, precision applications where regulation and innovation dictate demand. Growth is steady but restrained. Asia, by contrast, is characterized by rapid expansion, industrial diversification, and scale-driven consumption, with China, India, and Southeast Asia leading the surge.

Global growth forecasts for mold steels point to a healthy future, driven by automotive transformation, aerospace innovation, and infrastructure needs. Yet challenges—ranging from sustainability pressures in Europe to overcapacity and quality consistency in Asia—must be managed carefully by producers and buyers alike.

Ultimately, the contrast between mature specialization and expansive growth defines today’s market for 1.2344 tool steel. Companies that adapt sourcing strategies to balance European quality with Asian scale are best positioned to secure reliable supply chains in this evolving landscape.