The Russian tool steel market is undergoing significant shifts, particularly in relation to 1.2344 tool steel (also known as H13), which has long been a cornerstone material for hot-work applications. With rising industrial demand, geopolitical pressures, and supply chain challenges, the Russian landscape for 1.2344 is in a period of both opportunity and turbulence. This article explores the key trends shaping the market and the challenges buyers and suppliers face in the current environment.

Rising Demand from Die Casting and Injection Moulding Sectors

One of the strongest forces driving the Russian market for 1.2344 is its critical use in die casting, extrusion, and injection moulding. These industries depend on tool steels that can withstand extreme heat cycles and mechanical stresses, making 1.2344 an optimal choice due to its:

-

High resistance to thermal fatigue

-

Excellent toughness and hot hardness

-

Ability to retain strength under repeated heating and cooling

Russia’s expanding automotive industry, heavy equipment manufacturing, and consumer products sectors are creating steady demand for durable tooling solutions. As more companies seek efficiency in mass production, the reliance on 1.2344 tool steel continues to grow.

Shift Toward Import Substitution Policies

Since 2022, Russia has accelerated efforts to reduce dependence on Western imports through import substitution programs. This push includes specialty tool steels such as 1.2344, which historically relied on established European or Japanese producers.

The government has incentivized investment in domestic metallurgical capacity, offering subsidies and strategic support for local producers. However, this transition period is marked by:

- Fragmented supply chains

- Higher production costs due to lower economies of scale

- Delays in achieving international quality benchmarks

While the policy reduces geopolitical risks, the immediate challenge is balancing local production development with the practical needs of industries that cannot afford inconsistencies in tooling materials.

Increased Use in High-Temperature Industrial Applications

Beyond automotive and consumer goods, 1.2344 tool steel (X40CrMoV5-1) plays an essential role in high-temperature industrial sectors. Russian foundries and forging plants use it extensively in:

- Aluminum and zinc die casting

- Hot forging of steel components

- Extrusion of non-ferrous alloys

Its combination of thermal shock resistance and durability ensures longevity in tools that face severe wear. As domestic production volumes increase in sectors like construction equipment and aerospace components, the reliance on 1.2344 is projected to rise further.

Growing Price Volatility and Supplier Fragmentation

The Russian market has faced significant price volatility for 1.2344 tool steel, largely due to global and local disruptions. Contributing factors include:

- Western sanctions restricting direct imports

- Indirect sourcing through third-party intermediaries

- Higher logistics and customs costs

- Reduced competition among approved suppliers

Unlike international benchmarks where prices follow more predictable patterns, Russian buyers often see wide fluctuations in cost, making procurement planning more complex.

Limited Domestic Production Capabilities

Although Russia is investing in steelmaking infrastructure, domestic capacity for producing high-grade 1.2344 remains limited. Traditionally, industries relied on leading brands.

Replicating the technological expertise, quality consistency, and production scale of these established suppliers is a gradual process. Russian mills must overcome challenges in alloy refining, heat treatment precision, and testing standards before they can fully replace imports.

Sanctions Impacting Western Supplier Access

One of the most immediate consequences of ongoing sanctions is the restriction of direct supply channels from Western tool steel producers. This has forced Russian buyers to:

- Rely on secondary markets or non-traditional suppliers

- Face longer lead times and uncertain certification standards

- Manage risks of counterfeit or substandard products

The loss of technical partnerships with established Western brands has also reduced access to advanced expertise in tool optimization.

Raw Material Supply Chain Constraints

Another pressing issue is the availability of high-quality alloying elements, including chromium, molybdenum, and vanadium. These are essential for ensuring the heat resistance and toughness of 1.2344.

Russia faces challenges such as:

- Global shortages of certain alloying elements

- Logistical bottlenecks within domestic supply chains

- Export controls and price spikes in critical raw materials

These factors put upward pressure on production costs, affecting both domestic producers and end-users.

Quality Consistency and Certification Challenges

As new domestic players and alternative suppliers enter the market, variability in quality and certification has become a key concern. For industries like automotive and aerospace, which require precise performance and traceability, inconsistencies in:

- Mechanical properties

- Batch uniformity

- Documentation and certification

can lead to costly production issues. Without strong quality assurance frameworks, Russian buyers face higher risks when procuring from emerging suppliers.

Lengthening Lead Times for Industrial End Users

Procurement cycles for 1.2344 tool steel in Russia have grown longer due to a combination of:

- Customs and import clearance delays

- New supplier vetting requirements

- Limited logistics options due to rerouted trade flows

For manufacturers, this means reduced agility in production planning, as delays in tool steel delivery can slow down the entire manufacturing cycle.

Limited Availability of Technical Support and After-Sales Service

With the withdrawal of major international brands, Russian buyers also face a shortage of technical consultancy and after-sales services. End-users often lack access to:

- Guidance on heat treatment optimization

- Advice on tool maintenance and repair

- Troubleshooting for complex tool failures

This absence of support reduces efficiency and can lead to higher tool consumption rates, increasing overall production costs.

Why Choose FCS Tool Steel as Your Supplier?

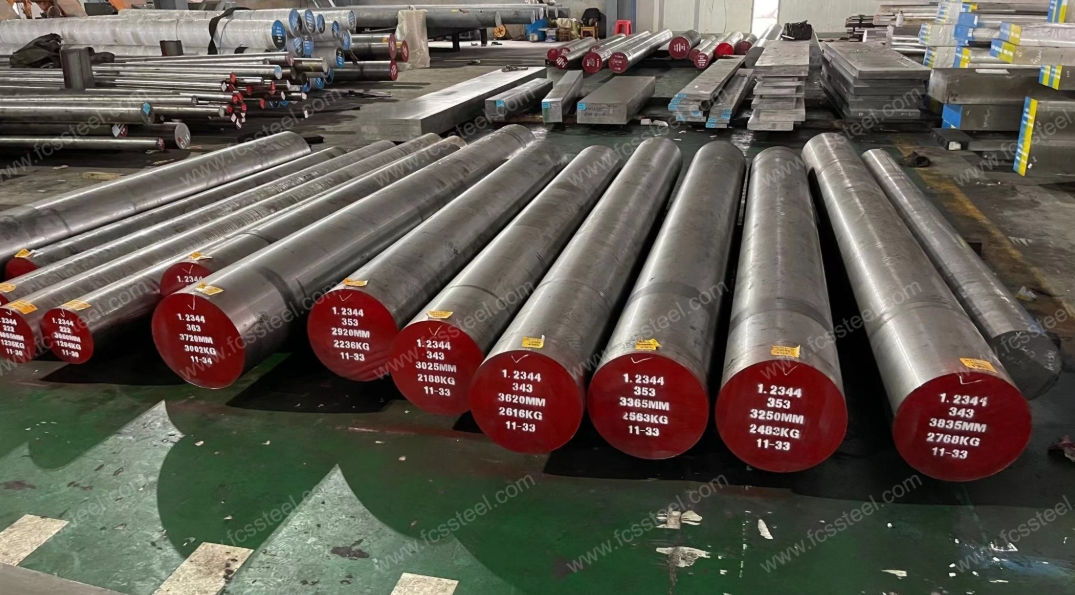

If you are troubled by issues such as inconsistent quality, delayed supply, or insufficient technical support when procuring 1.2344 tool steel (die steel) in Russia, FCS Tool Steel (Fucheng Tool Steel, China Huangshi) can provide a one-stop solution. As an enterprise specializing in the production of high-end tool steel (die steel), we have the following advantages:

Stable Production Capacity Guarantee

We can supply 5,000 tons of tool steel/die steel per month, including 1.2344 (H13) tool steel. Our products cover refined processes such as Electro-Slag Remelting (1.2344 ESR), which can meet the strict requirements of high-temperature operation scenarios.

Compliant Supply Channels

We can adapt to the needs of the Russian market through flexible logistics solutions, avoid the impact of trade barriers, and ensure controllable delivery cycles.

Full-Chain Technical Support

We provide 24/7 online technical services, covering heat treatment parameter optimization, die life extension suggestions, and troubleshooting. Meanwhile, we offer complete material certificates and international certifications (in line with DIN/ASTM standards).

Customized Solutions

According to the special needs of industries such as automotive and aerospace, we can provide customized specifications of round steel, steel plates, and pre-hardened products, helping customers reduce subsequent processing costs.

Whether you are looking for a stable alternative to imported supplies, or need to solve quality or delivery issues in your existing supply chain, please feel free to contact the FCS Tool Steel team. Based on your actual production needs, we will provide cost-effective 1.2344 tool steel (die steel) products and localized service support, helping you reduce risks and improve production efficiency in a complex market environment.

Conclusion

The Russian market for 1.2344 tool steel is shaped by both strong demand and substantial challenges. On one hand, expanding industrial sectors such as die casting, forging, and extrusion ensure steady consumption of this high-performance material. On the other hand, sanctions, raw material constraints, and domestic production limitations continue to pressure pricing, availability, and quality.

In the coming years, Russia’s ability to expand local production capacity, ensure consistent quality standards, and stabilize supply chains will determine how well the market adapts. For buyers, careful supplier selection and risk management are essential strategies in navigating this evolving landscape.